accumulated earnings tax form

See the Instructions for Form 1120-W. Estimate your corporations taxes with Form 1120 or using the taxable income of last year.

Threshold values per currency and per payments account.

. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. Subsequent distributions by the S corporation to the shareholders often can be made tax-free. For a tax year by attaching a statement to a timely filed original or amended Form 1120S for that tax year.

In the statement the corporation must. The corporation must use electronic funds transfer to make installment payments of estimated tax. TurboTax download software comes with Forms Mode for your convenience but if you ever want to go back to filing your return with step-by-step guidance you can easily switch back with the click of a button and TurboTax will put your information in the right place on all the tax forms you need based on your tax situation.

Filling the forms involves giving instructions to your assignment. Improperly accumulated earnings tax IAET in the Philippines is imposed upon every corporation formed or availed for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and earnings and profits to accumulate instead of being divided or distributed. Form 5471 Schedule J Accumulated Earnings and Profits EP of Controlled Foreign Corporation 2018 Form 5471 Schedule J Accumulated Earnings and Profits EP of Controlled Foreign Corporation 2012 Form 5471 Schedule M Transactions Between Controlled Foreign Corporation and Shareholders or Other Related Persons.

An S corporation does not generate EP. Filed Pursuant to Rule 424b5 Registration Statement No. The payroll tax rate totals 124 percent of earnings up to the taxable maximum the rate is 62 percent from workers and 62 percent from employers and 124 percent from the self-employed.

If you decide to cancel your AdSense account and your account balance is greater than the cancelation threshold youll receive your final payment within approximately 90 days of the end of the month provided that youve completed the necessary steps to get paid. Accumulated Earnings Tax. Penalties may apply if the corporation does not make required estimated tax payment deposits.

BIR Form 1704 - Improperly Accumulated Earnings Tax Return For Corporations Documentary Requirements. Earnings are treated as distributed out of the most recently accumulated earnings and profits. Enter the amount of uncollected social security tax and Medicare tax in box 12 of Form W-2 with codes A and B respectively.

Topic subject area number of pages spacing urgency academic level number of sources style and preferred language style. Subtract this deferred tax amount from the sum of lines 7 8 and 10 and enter the difference on line 11. Easily switch between Tax Forms View and Interview Mode.

Tax Forms. Report a negative adjustment on Form 941 line 9 Form 944 line 6 for the uncollected social security and Medicare taxes. This article discusses the opportunities and explores solutions to the problems.

As of 2013 the top 1 of households the upper class owned 367 of all privately held wealth and the next 19 the managerial professional and small business stratum had 522 which means that just 20 of the people owned a remarkable 89 leaving only 11 of the wealth for. Statutory rate due to unfavorable adjustments related to prior years. Made to avoid the parts of the accuracy-related penalty imposed for disregard of rules or substantial understatement of tax.

Filling the forms involves giving instructions to your assignment. The information needed include. To figure the amount for line 17b attach a computation showing 1 the IC-DISCs foreign investment in producers loans during the tax year.

Here there is a form to fill. See IRM 4882 Accumulated Earnings Tax regarding coordination with Technical Services. S corporations that have accumulated C corporation earnings and profits have both problems and opportunities.

In the United States wealth is highly concentrated in relatively few hands. For corporations enter this deferred tax on Form 1120 Schedule J in brackets to the left of the entry space for line 11. The information needed include.

However the taxation of distributions is more complicated if the S corporation has C corporation accumulated earnings and profits EP. And 3 accumulated IC-DISC income. However only the distributions made from current or accumulated EP will reduce EP.

Topic subject area number of pages spacing urgency academic level number of sources style and preferred language style. Here there is a form to fill. The information in this preliminary prospectus supplement is not complete and may be changed.

Download or print the 2021 New Jersey Individual Tax Instructions Form NJ-1040 Instructions for FREE from the New Jersey Division of Revenue. See Estimated tax penalty. Generally the E.

Form 1041 is similar to Form 1040. Photocopy of Annual Income Tax Return BIR Form 1702 with Audited Financial Statements andor Account Information Form of the covered taxable year duly received by the BIR. 23 In addition to reviewing the Schedule M-2 Analysis of Unappropriated Retained Earnings per Books from a corporations annual Form 1120 a detailed analysis of.

Also use Form 8275 for disclosures relating to preparer penalties for understatements. Additional factors are set forth in the Companys Annual Report on Form 10-K for the year ended October 2 2021 under Item 1A Risk Factors Item 7 Managements Discussion and. Sworn declaration as to dividends declared taken from the.

A limited form of the Social Security program began. Consider additional taxes such as employment payroll self-employment tax federal income tax and accumulated earnings tax. On this form the trust deducts from its own taxable income any interest it.

Use Form 1120-W Estimated Tax for Corporations as a worksheet to compute estimated tax. Note differences between paying taxes for an S corporation and an LLC. Typically 5 of salary each and by the compounded investment earnings of the accumulated.

The two most important tax forms for trusts are the 1041 and the K-1. 2 accumulated earnings and profits including earnings and profits for the current tax year minus the amount on Part I line 16. Each payments account within your.

The effective income tax rate in the current quarter was higher than the US. IRC 534b requires that taxpayers be notified if a proposed notice of deficiency includes an amount with respect to the accumulated earnings tax imposed by IRC 531 so that the burden of proof initially will be on a taxpayer. Dont include any uncollected Additional Medicare Tax in box 12 of Form W-2.

A tax imposed by the federal government upon companies with retained earnings deemed to be unreasonable and in excess of what is considered ordinary.

/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

A Retained Earnings Statement Is Used By Accountants To Also Keep Track Of A Tax Payer S Accounts Sales Report Template Statement Template Report Template

Demystifying Irc Section 965 Math The Cpa Journal

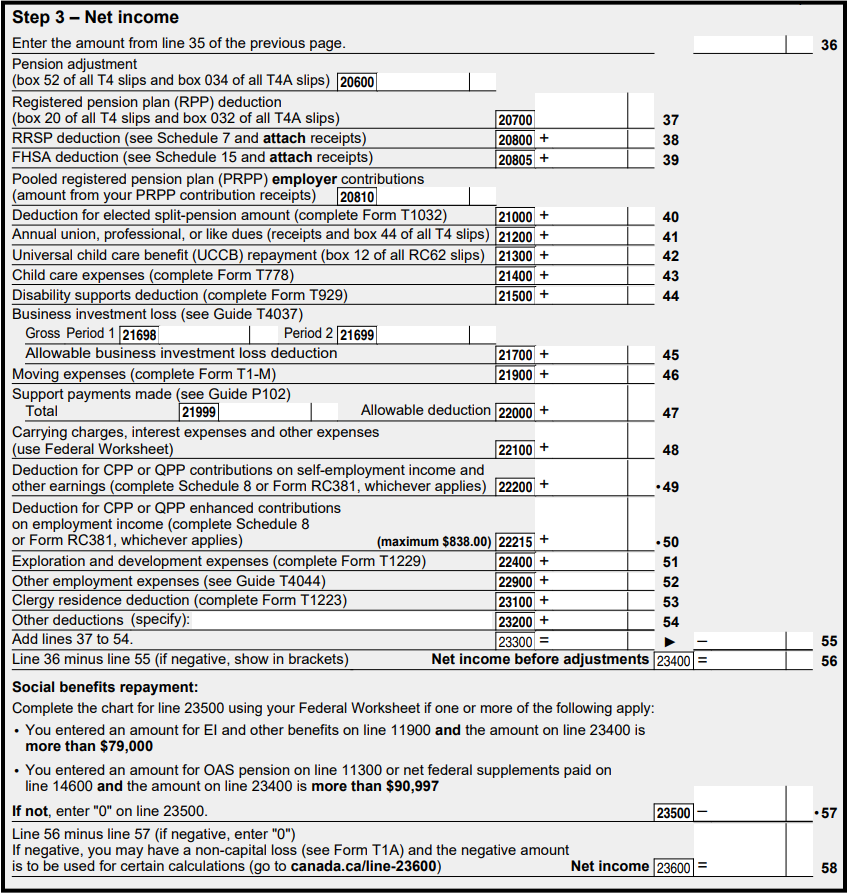

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

What Are Retained Earnings Quickbooks Australia

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

Earnings And Profits Computation Case Study

Earnings And Profits Computation Case Study

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Form 5471 Schedule J Accumulated Earnings Profits E P Of Controlled Foreign Corporation Youtube

What Are Earnings After Tax Bdc Ca

Determining The Taxability Of S Corporation Distributions Part Ii

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

What Are Retained Earnings Bdc Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca